JPMorgan’s Dimon Warns of ‘Unsettling’ Pressures as Bank’s Earnings Wobble

Jamie Dimon, the chief executive of JPMorgan Chase, on Friday warned of an “unsettling” global landscape, highlighting a cascade of pressures including war, rising geopolitical tensions and inflation that threaten the economy and could weigh on the performance of the nation’s largest bank.

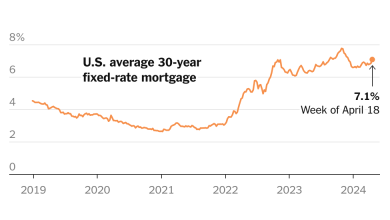

Mr. Dimon’s remarks, made concurrently with his bank’s weaker-than-expectedquarterly earnings report, add to his litany of concerns about the U.S. economy as the Federal Reserve grapples with when or whether to lower interest rates, particularly in light of this week’s hotter-than-expected inflation data.

“We have never truly experienced the full effect of quantitative tightening on this scale,” Mr. Dimon said in a statement, referring to the Fed’s efforts to cool down the economy.

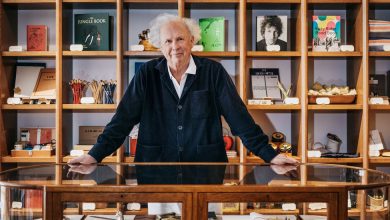

Mr. Dimon is the most prominent bank leader, and his pronouncements are closely followed on Wall Street and in Washington. He was the only head of a major American lender to attend this week’s White House state dinner for Japan’s prime minister.

His gloom, however, has also been consistently at odds with heady financial markets. In late 2022, for instance, he predicted economic bumps and, potentially, a severe recession for the next year; instead, the American economy boomed in 2023.

Others have been similarly confounded. Many economists predicted that this year would bring a so-called soft landing, or a gentle easing in growth and inflation that would allow the Federal Reserve to lower interest rates in an orderly fashion.

Now, with little indication of any slowdown, it is unclear whether the central bank will make the three interest rate cuts that officials had predicted for the year. Mr. Dimon has been among the few to say they are preparing for the possibility that interest rates will be raised again, a move that would suggest more extreme inflation than is currently being measured.

Mr. Dimon made more extended remarks on the tricky environment in his annual letter to shareholders this week. He lamented, as he had before, that the United States engaged in deficit spending and ticked off a list of complaints about where public and private leaders have fallen short. (“Social media could do more,” he wrote.) Referring to Russia’s invasion of Ukraine and other crises, he wrote that recent events “may very well be creating risks that could eclipse anything since World War II.”

JPMorgan’s financial performance was impacted by more ordinary issues. While it earned more than $13 billion in the first quarter, the bank’s average customer deposits fell and it warned of higher expenses in the future. JPMorgan also disclosed a fall in its so-called net interest income, a closely watched financial metric that essentially measures how much money it is able to make from lending.

Wells Fargo, the nation’s third-largest bank, on Friday separately reported earnings that also included a drop in that measure.

JPMorgan’s shares were down 3 percent in trading before markets opened on Friday.